Tobacco Affordability Fuelling Cancer Epidemic in India

Why in the News?

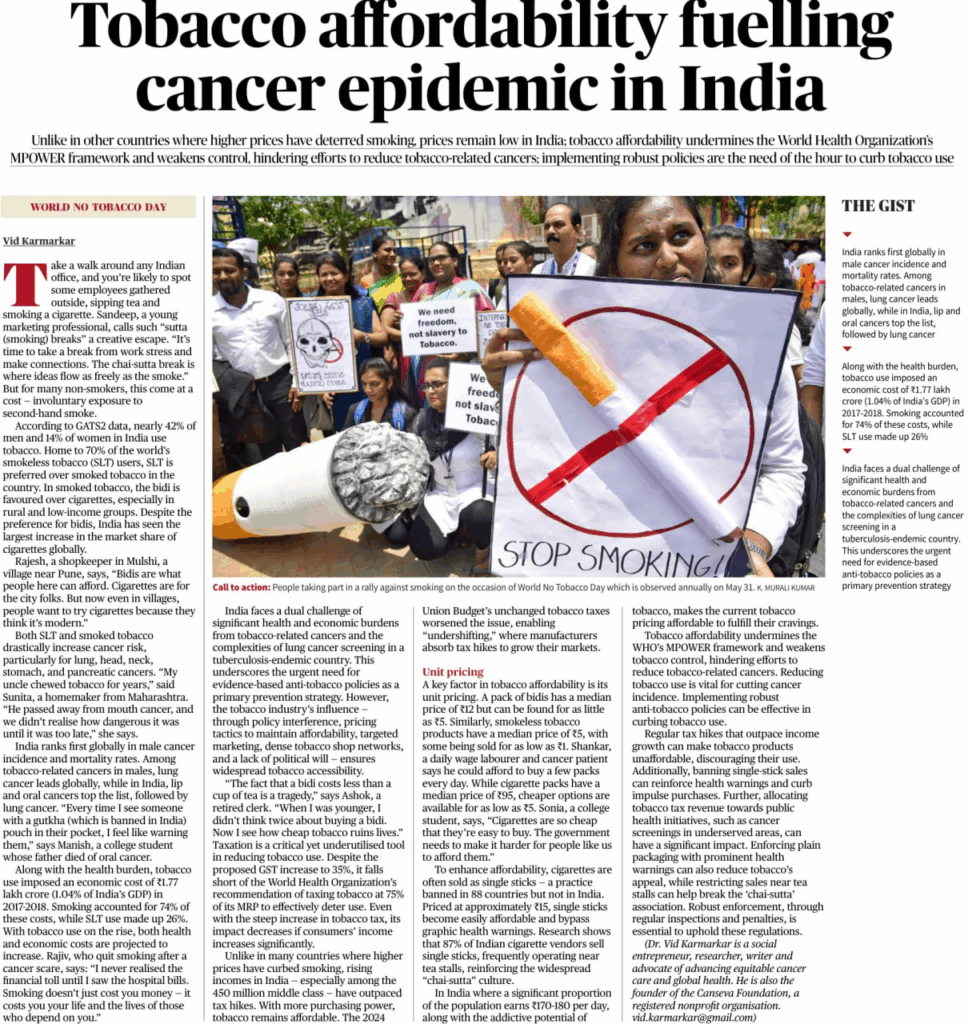

On the occasion of World No Tobacco Day (May 31), recent studies and public health campaigns have raised alarms over the increasing affordability of tobacco in India and its direct link to the rising incidence of cancer, especially oral and lung cancers.

Despite global trends showing that higher tobacco prices reduce consumption, India’s low unit pricing and tax stagnation continue to make tobacco easily accessible. The issue undermines WHO’s MPOWER strategy and endangers public health, necessitating urgent intervention.

Background

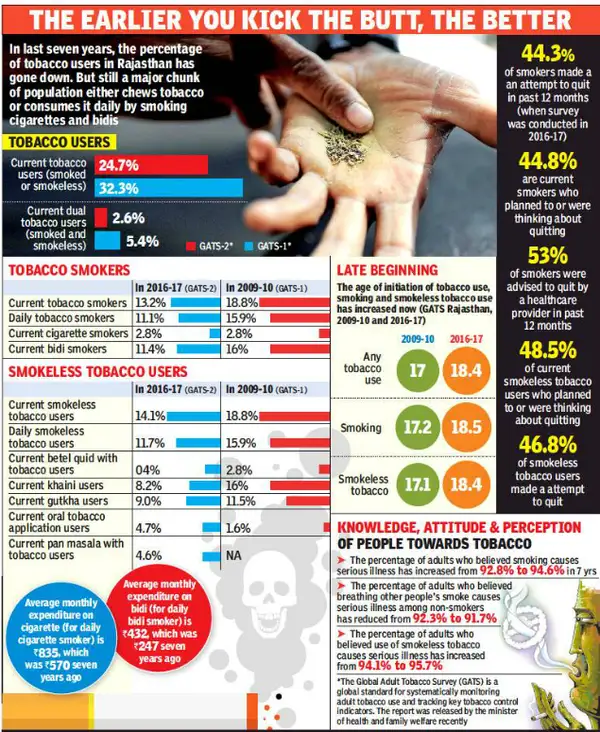

Tobacco use is a leading cause of preventable deaths worldwide. In India, it accounts for nearly 1.35 million deaths annually. The Global Adult Tobacco Survey-2 (GATS2) found that 42% of men and 14% of women in India use tobacco in some form. India also has the largest number of smokeless tobacco users globally – around 70% of global SLT users reside in India.

India presents a unique dual tobacco market:

- Smoked tobacco: Mostly in the form of bidis and cigarettes, with bidis preferred in rural and low-income groups due to affordability.

- Smokeless tobacco (SLT): Widely consumed as gutkha, khaini, and zarda.

- Notably, the economic cost of tobacco use in India was ₹1.77 lakh crore (approximately 1.04% of India’s GDP) in 2017-18. This includes healthcare costs and loss of productivity. As tobacco use continues to grow, the health burden, particularly from cancers of the lip, oral cavity, and lungs, is expected to intensify

Features of Tobacco Affordability and Use in India

- Low Unit Pricing

- Bidis are sold for as low as ₹5 per pack.

- Smokeless tobacco products can cost as little as ₹1.

- Cigarettes, although costlier (median price ₹95/pack), are available as single sticks for ₹15 or less, bypassing pictorial health warnings.

Widespread Availability

- Cigarettes and SLT products are sold through densely located informal vendors, often around schools, offices, and tea stalls.

- Over 87% of cigarette vendors sell single sticks, encouraging impulse buying and youth experimentation.

Cultural Normalisation

- Practices like the “chai-sutta” break at workplaces and colleges glamorise smoking as a stress-reliever and social activity.

- Perceptions of cigarettes as symbols of modernity have driven increased rural consumption.

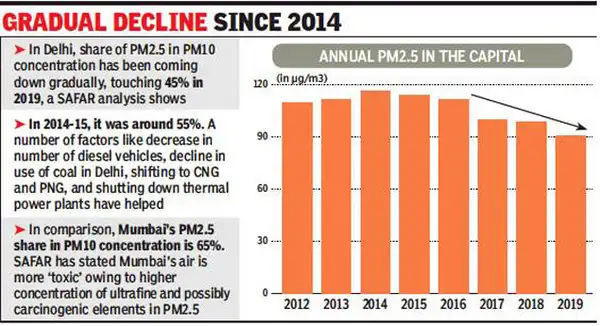

Income Growth Outpacing Taxation

- With India’s burgeoning middle class, rising incomes have made tobacco more affordable despite minor tax increases.

- The 2024 Union Budget did not raise tobacco taxes, allowing the industry to maintain affordability through “undershifting” (absorbing tax costs instead of raising prices).

- Gender and Socioeconomic Disparities

- Tobacco use is higher among men, rural populations, and economically weaker sections.

- Women, although less likely to smoke, are often exposed to second-hand smoke, increasing their health risk.

Challenges

Policy and Regulatory Weaknesses

- Inadequate taxation: India’s tobacco tax is far below the WHO recommendation of 75% of MRP.

- GST on bidis is only 28% with no compensation cess, keeping them ultra-affordable.

- Lack of ban on single-stick sales: Despite being banned in 88 countries, India allows it, undermining packaging warnings and health campaigns.

Industry Interference

- The tobacco lobby resists stronger regulations through advertising, lobbying, and price manipulation.

- Tactics like flavouring products and sponsoring local events target young and rural consumers.

Health Infrastructure Constraints

- Limited availability of screening and early diagnosis, especially in rural areas.

- Cancer care costs are high, and many patients report late due to a lack of awareness and accessibility.

Tuberculosis and Cancer Dual Burden

- India faces the world’s highest TB burden, complicating lung cancer diagnosis and screening due to overlapping symptoms.

Social Acceptance and Addiction

- Social practices and peer pressure contribute to addiction.

- Nicotine addiction is difficult to overcome without structured cessation support, which is scarce in public health facilities.

- Second-hand Smoke: Non-smokers face elevated risk, especially children and women in households where male members smoke indoors.

- Health Costs: Oral and lung cancers are among the most expensive to treat. Many families fall into poverty due to out-of-pocket treatment expenses.

- Workforce Loss: India loses significant productivity due to tobacco-related diseases.

Way Forward

Raise Tobacco Taxes Significantly

- Implement the WHO-recommended taxation level of 75% of MRP.

- Equalise taxation between bidis and cigarettes to discourage bidi consumption among the poor.

Ban Single-Stick Sales

- Enforce a national ban to prevent evasion of packaging laws.

- Coupled with larger graphic warnings and plain packaging, this can reduce youth initiation.

Invest in Tobacco Cessation Infrastructure

- Expand tobacco cessation clinics at primary healthcare centres.

- Integrate counselling and pharmacological therapy with other national health programmes.

Public Awareness Campaigns

- Targeted, culturally sensitive campaigns in regional languages.

- Use digital media to reach young people with anti-tobacco messaging.

Regulate Vendor Proximity to Schools and Workplaces

- Implement zoning laws to restrict sales within a 100-metre radius of schools, offices, and public places.

- Penalise violations through local civic bodies.

Use Tax Revenue for Cancer Prevention

- Allocate part of the collected tobacco tax to fund free cancer screening and awareness camps.

- This will reduce late-stage diagnoses and healthcare burden.

Strengthen MPOWER Compliance

- Conduct annual audits of tobacco control law implementation.

- Increase penalties for non-compliance and introduce vendor licensing systems.

Combat Industry Influence

- Enforce Article 5.3 of the WHO Framework Convention on Tobacco Control (FCTC) to protect policymaking from industry interference.

- Ban all forms of indirect advertising, including brand placement and sponsorships.

Conclusion

India’s battle against tobacco-related cancers is at a critical juncture. Affordability of tobacco, particularly among the poor and youth, has neutralised public health gains. The current situation calls for a multi-pronged, evidence-based approach that includes robust taxation, regulatory reforms, public education, and strengthened enforcement of WHO’s MPOWER framework.

MAINS PRACTICE QUESTION

Question . “Tobacco affordability in India is a public health crisis that undermines global frameworks like MPOWER and fuels a growing cancer epidemic.” Critically examine the statement. Suggest comprehensive policy measures to address the challenge.

PRELIMS PRACTICE QUESTION

Question. Consider the following statements for tobacco taxation in India:

- The GST rate on bidis is lower than that on cigarettes.

- The WHO recommends that tobacco taxes should comprise at least 75% of the retail price.

- India currently meets the WHO benchmark for tobacco taxation.

Which of the above statements is/are correct?

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 1, 2 and 3

Answer: A. 1 and 2 only

Explanation:

- Statement 1 is correct: Bidis are taxed at 28% under GST without a compensation cess, while cigarettes have an additional cess.

- Statement 2 is correct: WHO recommends ≥75% tax on the tobacco retail price.

- Statement 3 is incorrect: India falls short of the WHO benchmark.