The Sorry State of South Asian Economic Integration

Why in the News?

Two recent developments have highlighted the urgent need for deeper regional cooperation in South Asia.

- First, the reimposition of reciprocal tariffs by the U.S. on Indian goods strained global trade ties. Second, a terror attack in Pahalgam underscored the region’s volatile security environment.

- While these events may seem disconnected, they reflect a deeper truth: economic and national security in South Asia are interlinked, and both are suffering from the absence of meaningful regional integration.

- Despite its shared history, cultural affinities, and economic complementarities, South Asia remains the least economically integrated region in the world. This structural under-integration poses a serious challenge to growth, stability, and regional peace.

Geography has made us neighbours. History has made us rivals. Economics must make us partners.

Background: A Region with Promise but Poor Performance

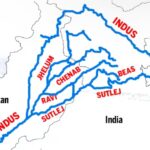

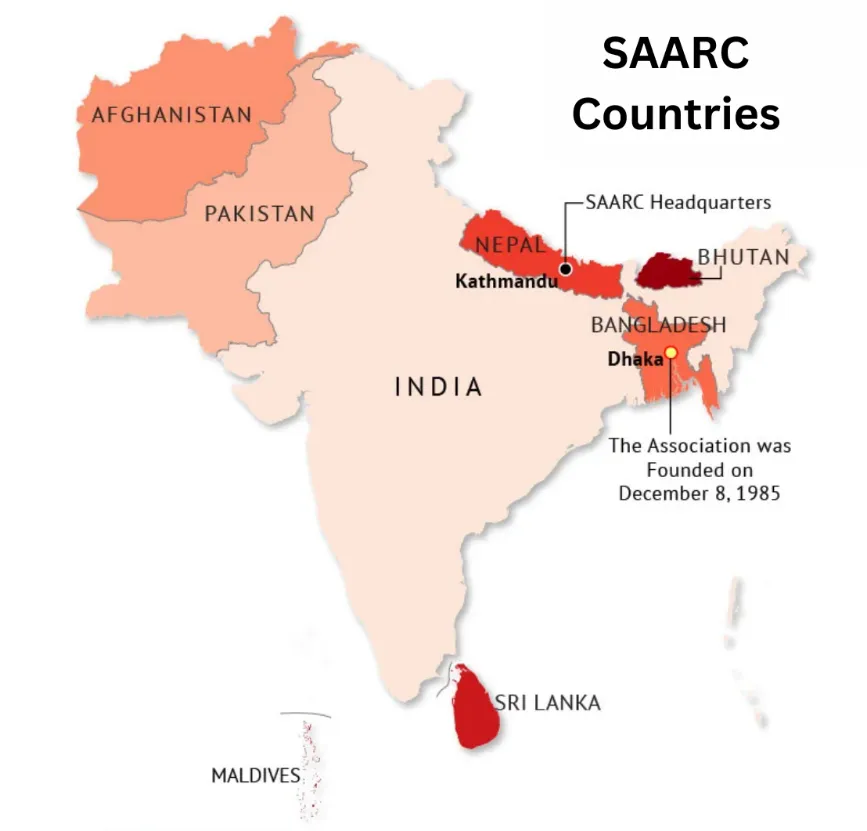

South Asia, comprising eight countries: Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka under the SAARC (South Asian Association for Regional Cooperation) umbrella, represents nearly a quarter of the global population (25%). However, the region’s economic integration is abysmally low.

The South Asian Free Trade Area (SAFTA), launched in 2006, was intended to foster regional trade and cooperation. But intra-SAARC trade remains between just 5% and 7% of total trade, the lowest of any regional trading bloc. This compares poorly to:

- EU: ~45%

- ASEAN: ~22%

- NAFTA (now USMCA): ~25%

UNESCAP estimated that South Asia’s potential for intraregional trade could have reached $172 billion by 2020. However, current trade stands at just $23 billion, meaning more than 80% of trade potential remains unutilised.

Key Features of South Asia’s Economic Under-Integration

Trade Potential vs Reality

The UNESCAP South Asia Gravity Model highlights huge gaps:

- Bangladesh: 93% of trade potential untapped

- Maldives: 88%

- Pakistan: 86%

- Afghanistan: 83%

- Nepal: 76%

Declining Trade-to-GDP Ratio

South Asia’s trade-to-GDP ratio has declined from 47.3% in 2022 to 42.94% in 2024, indicating increasing economic inwardness despite the post-pandemic recovery.

Rising Trade Deficit

The trade deficit of the region increased:

- From $204.1 billion in 2015 to $339 billion in 2022

- Total trade (exports + imports) grew to $1,335 billion in the same period

India-Pakistan Trade Breakdown

Bilateral trade fell from:

- $2.41 billion (2018) → $1.2 billion (2024)

- Pakistani exports to India dropped from $547.5 million (2019) to a meagre $480,000 (2024)

High Intra-Regional Trade Costs

- Intra-SAARC trade costs: 114% of the value of goods

- Trade with the U.S. costs only 109%, despite the geographic distance

- It is cheaper to trade with Brazil (22 times farther) than with Pakistan

In contrast, intra-ASEAN trade costs are around 76%, offering better economic integration through lower logistical costs and higher trust.

Major Challenges to Regional Integration

Despite decades of diplomatic summits, declarations, and trade agreements, South Asian integration has faltered for several deep-rooted reasons:

Geopolitical Rivalries and Trust Deficit

- India-Pakistan hostilities are the biggest roadblock, with unresolved issues like Kashmir and terrorism derailing SAARC cooperation.

- Frequent diplomatic boycotts have paralysed SAARC summits (none held since 2014)

Non-Tariff Barriers (NTBs) and Red Tape

- Customs inefficiencies, lack of standard harmonisation, and non-transparent regulations increase costs and delays.

- NTBs are used as geopolitical tools to stifle trade, especially in agriculture, pharmaceuticals, and consumer goods.

Inadequate Physical and Digital Infrastructure

- Border infrastructure remains poor, especially for landlocked countries like Nepal, Bhutan, and Afghanistan.

- Regional railways, roads, and electronic data interchange (EDI) systems are underdeveloped or poorly coordinated.d

Weak Institutional Mechanisms

- SAFTA has no binding enforcement or dispute resolution mechanisms

- The SAARC Development Fund is underfunded and underutilised

Absence of Regional Value Chains

- Unlike ASEAN or East Asia, South Asia lacks industrial or service-oriented cross-border supply chains.ns

- Most countries export to Western markets instead of building regional interdependence.

Protectionist Mindsets and Political Populism

- Nationalistic policies, import bans, and ‘self-reliance’ narratives hinder regional trade.e

- Political leaders often use anti-neighbour rhetoric for domestic electoral gain.

Comparison with Other Regional Blocs South Asia lags due to a lack of political consensus, infrastructure, and enforceable frameworks.

Way Forward: Pathways to a More Integrated South Asia

A reimagined South Asian regionalism must be people-centric, pragmatic, and politically insulated. Some steps to unlock the region’s potential include:

Revive or Reform SAARC

- Re-energise SAARC with new institutional mechanisms for trade dispute resolution, investment promotion, and logistics support

- Explore alternative forums like BIMSTEC, BBIN, and India-Bangladesh bilateral corridors if SAARC remains gridlocked.

Build Conflict-Neutral Trade Corridors

- Keep trade and humanitarian exchanges insulated from geopolitical tensions

- Expand border haats, integrated check-posts (ICPs), and multimodal logistics parks

Reduce Non-Tariff Barriers

- Harmonise sanitary and phytosanitary (SPS) standards

- Establish mutual recognition agreements (MRAs) on conformity assessments, licensing, and e-documentation

Invest in Cross-Border Infrastructure

- Develop rail-road links, coastal shipping networks, and inland waterways (e.g., India-Bangladesh protocol route)

- Expand digital connectivity to enable smoother e-commerce and fintech transactions

Promote Regional Value Chains

- Focus on labour-intensive industries:

- Textiles (India-Bangladesh)

- Agro-products (India-Nepal)

- Tourism circuits (India-Bhutan-Sri Lanka)

- Enable investment pooling and joint R&D

Liberalise Service Trade

- Open markets for education, medical tourism, IT, and BPO services

- Create regional visa schemes for students, researchers, and professionals

Involve the Private Sector and Civil Society

- Set up the South Asian Business Council with cross-border chambers of commerce.

- Promote academic exchanges, cultural festivals, and youth summits to build soft power and trust.

Conclusion: From Mutual Suspicion to Mutual Prosperity

South Asia’s persistent economic under-integration is a classic case of geopolitics defeating geoeconomics. Despite clear economic incentives, regional trade remains hostage to mistrust, unresolved conflicts, and institutional weakness. While other regions have used economic integration as a pathway to peace and prosperity, South Asia continues to squander its potential through political inertia.

The solution lies not in more declarations, but in smaller, trust-building economic actions: harmonising rules, investing in infrastructure, and building people-to-people trust. Trade must no longer be viewed as a political tool, but as a stabilising force that builds long-term peace and prosperity.

FAQ: SAARC and Regional Integration in South Asia

1. What is SAARC, and why has it failed to deliver?

The South Asian Association for Regional Cooperation (SAARC) was founded to promote political and economic cooperation among eight South Asian nations. However, India-Pakistan tensions, limited enforcement mechanisms, and a lack of political will have stalled progress. The last summit was held in 2014.

2. How does South Asia compare to other regional blocs?

South Asia’s intra-regional trade is merely 5–7% of its total trade, in contrast with:

- European Union: ~45%

- ASEAN: ~22%

- NAFTA (USMCA): ~25%

3. What are the biggest challenges to integration?

Major obstacles include:

- India-Pakistan political tensions

- High non-tariff barriers (NTBs)

- Customs delays and poor logistics

- Weak infrastructure and lack of trust

- Protectionist and nationalist policies

4. What does the data show about South Asian trade?

- Over 80% of intra-regional trade potential remains unrealised.

- Trade costs within South Asia (~114%) are higher than with distant partners like the U.S. or Brazil.

- India-Pakistan trade volume has dropped by half since 2018.

5. What are some proposed solutions?

- Shift focus to smaller groupings like BIMSTEC or BBIN.

- Build neutral trade corridors and shared infrastructure.

- Reduce NTBs and harmonise standards and procedures.

- Boost cooperation in education, healthcare, and R&D.

- Develop regional value chains in textiles, agri-products, and services.

MAINS PRACTICE QUESTION

Question: Why has South Asia failed to achieve meaningful economic integration despite regional trade agreements like SAFTA? Discuss the key challenges and suggest measures to improve intra-regional trade and cooperation.

PRELIMS PRACTICE QUESTION

Q. Regarding the South Asian Free Trade Area (SAFTA), which of the following statements is/are correct?

- SAFTA was signed under the auspices of BIMSTEC in 2004.

- It allows zero customs duty on the trade of all products among SAARC nations.

- India and Pakistan have fully implemented SAFTA without any restrictions.

Select the correct answer using the code below: